Personal Loans for Debt Consolidation simplify home buying by merging multiple high-interest debts into a single loan with potentially lower rates and fixed terms, freeing up cash flow and protecting against future rate changes. Evaluate your financial situation, credit score, lenders, and compare loan terms to find the best fit for both immediate needs and long-term goals.

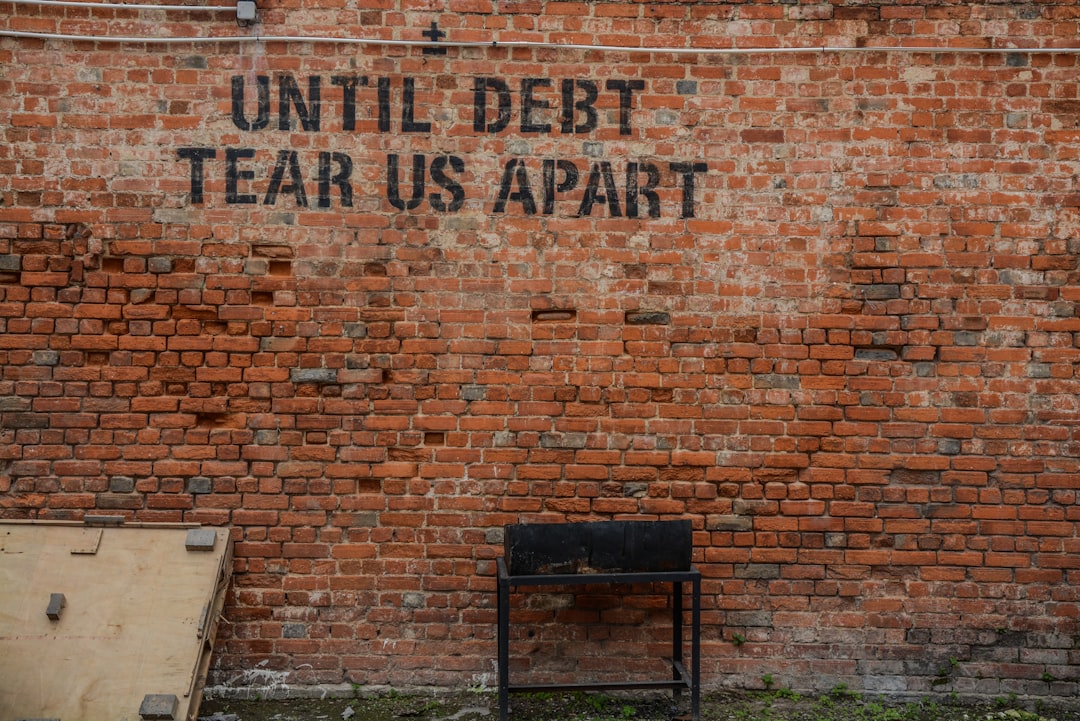

Considering buying your dream home but burdened by debt? Explore powerful tools like Debt Consolidation Mortgages, offering a strategic path to financial freedom. This article delves into two key options: personal loans for debt consolidation. We’ll guide you through understanding these innovative financing solutions and how they can simplify the process of acquiring a new home. By consolidating debts, you may qualify for better mortgage rates and lower monthly payments, making your homeownership aspirations more attainable.

Understanding Debt Consolidation Mortgages

Debt consolidation mortgages offer a strategic approach to buying a new home by combining multiple debts into a single loan, often with a lower interest rate. This method is particularly beneficial for those burdened by high-interest credit card debt or other loans. By restructuring their debt through a personal loan for debt consolidation, homeowners can simplify their financial obligations and potentially save money in the long run.

These mortgages allow borrowers to pay off various debts, including credit cards, personal loans, and even existing mortgages, with a single monthly payment. This streamlines repayment and can free up cash flow, making it easier to afford a new home. Additionally, debt consolidation mortgages often come with fixed interest rates, providing borrowers with financial predictability and protection against potential rate fluctuations in the future.

Navigating Personal Loans for Debt Relief

When considering a new home purchase, many homeowners-to-be face the challenge of managing existing debts. This is where personal loans for debt consolidation can play a pivotal role. These loans offer a strategic approach to debt management by combining multiple high-interest debts into one single loan with potentially lower interest rates. The process involves evaluating your financial situation, understanding your credit score and securing a suitable personal loan that aligns with your repayment capacity.

Personal loans for debt consolidation provide a clear repayment plan, allowing you to focus on building equity in your new home without the burden of multiple payments. This not only simplifies your finances but can also save money by reducing overall interest expenses. It’s essential to research different lenders and compare loan terms to find the best fit for your financial needs and long-term goals.

When considering buying a new home, exploring debt consolidation mortgage options like personal loans can provide much-needed financial flexibility. By understanding these strategies and navigating the available loan types, you can take control of your debt and make a significant step towards achieving your homeownership dreams. Personal Loans for Debt Consolidation offer a viable path to simplifying debt payments, freeing up cash flow, and potentially speeding up your journey to home ownership.