Personal Loans for Debt Consolidation offer individuals with bad credit a strategic solution by combining multiple high-interest debts into one affordable loan. This simplifies borrowing, reduces payments, and lowers rates. Before applying, assess your credit situation, understand debt amounts, and compare lender terms. Prepare by gathering financial statements and improving credit score. After repayment, rebuild credit through responsible financial behavior and monitoring reports.

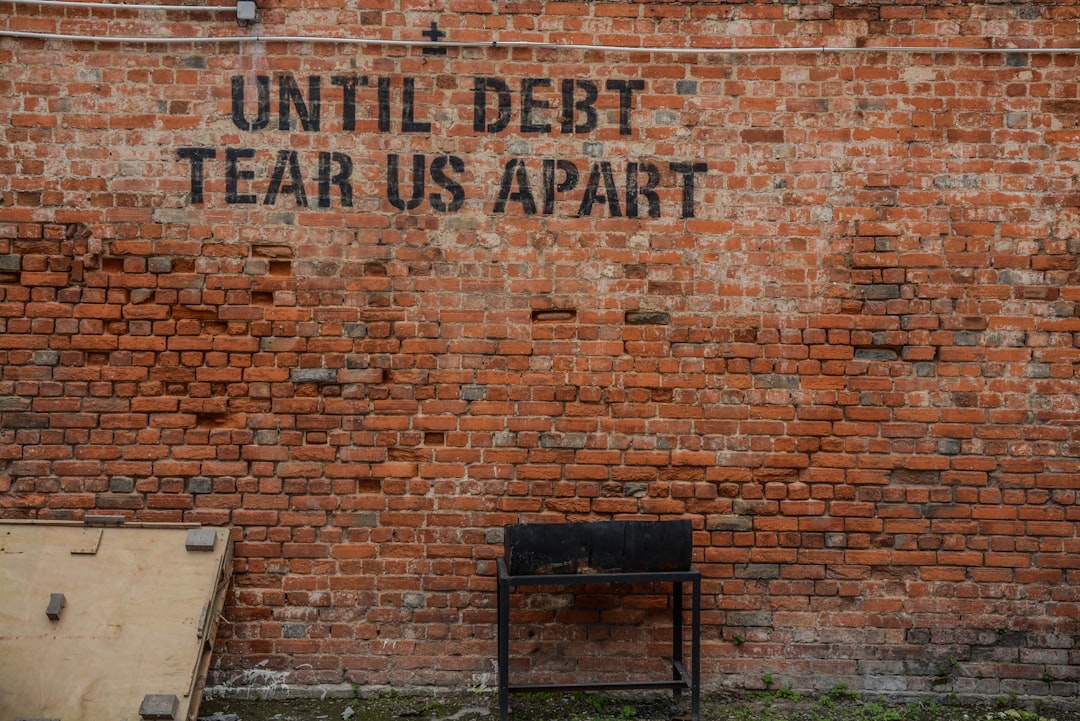

Struggling with multiple debts due to a bad credit history? A Personal Loan for Debt Consolidation could offer much-needed relief. This comprehensive guide explores how unsecured consolidation loans can help you merge debt and simplify repayment. We’ll walk you through understanding these loans, assessing your unique situation, exploring top personal loan options, comparing lenders and rates, preparing for the application process, and even rebuilding your credit post-repayment.

- Understanding Unsecured Consolidation Loans

- Assessing Your Bad Credit Situation

- Exploring Personal Loan Options

- Comparing Lenders and Rates

- Preparing for the Application Process

- Building Credit After Repayment

Understanding Unsecured Consolidation Loans

Unsecured consolidation loans are a financial solution designed to simplify debt management by combining multiple high-interest debts into a single, more manageable loan. This approach can be particularly beneficial for individuals with bad credit history who are burdened by various unsecured debts like credit cards and personal loans. By consolidating these debts, borrowers can reduce their monthly payments, lower overall interest rates, and improve their financial stability.

These loans work by offering a new, consolidated loan with a fixed interest rate, typically over a longer repayment period. This simplifies the borrowing process, as there’s no need to keep track of multiple lenders and due dates. Moreover, since these are unsecured loans, they don’t require collateral, making them accessible to those with limited assets to use as security. This flexibility can be a game-changer for folks looking to regain control of their finances despite having a less-than-perfect credit history.

Assessing Your Bad Credit Situation

Before applying for any personal loans for debt consolidation, it’s crucial to assess and understand your bad credit situation. This involves reviewing your credit report to identify errors or discrepancies that might be affecting your score. Credit bureaus often make mistakes, so double-checking your report for inaccurate information can help improve your odds of approval.

Additionally, evaluating your current financial state is essential. Calculate your total debt amount and determine the interest rates you’re currently paying on each outstanding balance. This will give you a clear picture of how much you can save by consolidating. Understanding these factors enables you to approach lenders with realistic expectations, enhancing your chances of securing favourable terms for your personal loan.

Exploring Personal Loan Options

When considering personal loans for debt consolidation, it’s crucial to explore various options available in the market. These unsecured consolidation loans can be a game-changer for individuals with bad credit histories, offering a chance to streamline multiple debts into one manageable repayment. Several lenders specialize in providing these loans, catering to those seeking financial relief from overwhelming debt burdens.

One of the key benefits is the ease of application and approval process. Unlike traditional loans, personal consolidation loans often have less stringent requirements, making them accessible to a broader range of borrowers. This avenue allows individuals to focus on rebuilding their credit while efficiently managing their debt. With competitive interest rates and flexible repayment terms, these loans provide an opportunity for financial rejuvenation, enabling folks to regain control over their finances.

Comparing Lenders and Rates

When considering personal loans for debt consolidation, comparing lenders and interest rates is crucial. Start by researching different financial institutions and online lenders who specialize in unsecured consolidation loans. Look beyond just the advertised rates; consider factors like loan terms, repayment flexibility, and any additional fees or charges. Each lender may have varying criteria for borrowers with bad credit, so understanding their requirements upfront can save time.

Use comparison tools available online to easily assess multiple offers side by side. These tools allow you to filter options based on your credit history, desired loan amount, and preferred repayment period. By carefully evaluating rates and terms, you’ll be better equipped to find a lender who suits your needs and helps you achieve financial stability through debt consolidation.

Preparing for the Application Process

Before applying for unsecured consolidation loans, it’s crucial to prepare and understand the process. The first step is to assess your financial situation thoroughly. Gather all relevant documents, including statements for existing debts, income proof, and information about your bad credit history. This step is essential as lenders will need this data to evaluate your repayment capacity.

Additionally, improve your credit score if possible. While unsecured loans don’t typically require collateral, lenders may run a credit check, which could impact your approval chances. Consider making timely payments on any outstanding debts and keeping credit card balances low. These actions can positively influence your creditworthiness and increase the likelihood of securing favorable terms for your personal loans for debt consolidation.

Building Credit After Repayment

After successfully repaying a personal loan for debt consolidation, rebuilding your credit history becomes a crucial step. This process involves demonstrating responsible financial behavior to lenders and credit bureaus. One effective strategy is to use secured credit cards or high-limit credit cards with low balances to establish a positive payment track record. Timely bill payments, keeping balances low, and avoiding new debts will significantly enhance your credit score over time.

Additionally, regularly monitoring your credit report for errors or inaccuracies is essential. Disputing any incorrect information can help improve your overall creditworthiness. As you rebuild, consider diversifying your credit mix by exploring options like personal loans for debt consolidation, which can show lenders that you’re managing various types of credit responsibly.

When navigating personal loans for debt consolidation with bad credit, understanding your options is key. By assessing your financial situation, exploring various lenders, and preparing a solid application, you can access unsecured consolidation loans to improve your credit history. Remember that building credit responsibly after repayment is crucial for long-term financial health. Embrace this opportunity as a step towards financial stability and remember to compare rates to make an informed decision.